data Since the beginning of this year, more than 20 owners have published car-losing information only in a WeChat group called "Disposal Vehicle Ownership." The private car with a total value of over 10 million was resold by criminals. The longest lost time in these vehicles has reached 4 months. These owners are from many provinces such as Beijing, Shanghai, and Guangdong. They are located in Pocar Rental, Youyou Car Rental, PP Car Rental, and Au. Instead of letting the vehicle idle, it's better to put it on the car sharing platform. On a P2P platform, tenants and car owners are free to “pair up†to place orders online, pick up cars, and offer affordable prices. Behind the "dividend" is a risk. A large number of rented cars have no return, causing irreparable economic losses to the owners. On February 13 this year, Beijing Automotive advocated that Yang would rent his Volkswagen Golf Sedan to Tan Mou through the online car rental platform “Treasure Car Rentalâ€. Unexpectedly, after only three days, Zhang Yang found that his car was hung on the Internet for sale at a low price. Since the beginning of this year, only in a WeChat group that “looks for lost rental carsâ€, there is a private car with a total value of over 10 million that has been sold by criminals. According to the situation collected by the China Road Transport Association, in some areas, the proportion of leased vehicles that accounted for the total number of leased vehicles is up to 8%. Most fraudulent vehicles have flowed into the black market through investment guarantees, loan collateral, and other methods. Zhang Yibing, an expert from the China Road Transport Association, said that if a third-party mortgage platform receives a “good faith acquisition†or “buy, buy and sell†definition at the legal level when accepting low-priced vehicles at a low price, then the security environment for car rental will be It's hard to change. awkward The vehicle was illegally recovered and recovered Zhang Yang's exposure to the P2P car rental software was not accidental. She had used car rental software abroad. "Every time you run out of car, you're saving your car." In January of this year, Zhang Yang spent $180,000 to buy a "Volkswagen Golf" and was ready to rent out to earn extra money. Zhang Yang said that according to the daily rental price of 300 yuan, conservative calculations, her monthly income should reach 8,000 yuan. On February 11th, Zhang Yang signed up for a car to rent a car, claiming “zero loss of vehiclesâ€. On February 13th, Zhang Yang’s golf formally went online in Bao. In less than two hours, a man named Tan Xianghai placed an order. Then they met at the gate of the Donghu police station in Wangjing, showing relevant documents and signing orders. Within half an hour, the man successfully drove away. The attractiveness of the rental car is so rewarding that there is no sign of risk. On February 16, just on the third day when the car was rented to Tan Xianghai, Zhang Yang found that someone had sold his car online at a low price, so he quickly contacted him for driving a car. Po drive replied, "GPS display is abnormal", and then the tenant Tan Xianghai phone call, the other party has been shut down. Only then did she know that the car was "illegally mortgaged." GPS shows vehicles in Bazhou, Hebei, Zhang Yang contacted the "new car owner" the first time, the other claimed to be surnamed Sun, is the owner of a mortgage dealer, the car is spent in Hebei Bazhou spent 5.5 million yuan from a man named Wu Ming buy , You want to get a car to save money. After several negotiations and no success, Zhang Yang had no choice but to call the police. “Although the police have already set up a case, they promise to chase Tan Mou completely. However, it is not that easy to get a cable car. People need to be arrested first, so that the car can be returned if the incident is conclusive. Zhang Yang’s case is not a case. According to the data collected by China Road Transport Association, in recent years, the proportion of leased vehicles in China has accounted for 3% of leased vehicles, and over 8% in individual regions; fraudulent car leases in Shanghai, Zhangzhou, Fujian and Zhengzhou, Henan have exceeded 10 million yuan. In 2010, 1,700 vehicles in Nanning were deceived and car rental fraud cases worth RMB 180 million were reported. Finding a car Mortgage vehicles are qualitatively disputed From the moment he lost his car to the present, Zhang Yang spends his entire time looking for a car for almost two months. He can hardly work normally. After finding media and online help, Zhang Yang found that nearly 20 car owners had similar experiences with her. Apart from the treasure drive car rental platform, these car owners also had car owners from PP Car Rental, Youyou Car Rental and Bumper Car Rental. Not only the owner of the car was taken over, but also the owner of the used car dealer had eaten the "illegal mortgage" deficit. Jia Menghua is the boss of a used car dealership. He said that in the past two years, people have always rented a car, forged a document and then mortgaged it. When he first started, the police came to the door and he had to return the car to the owner. For this reason he has lost more than 80 million. Since then, Jia Menghua has been looking for fraudsters while also helping the owners search for cars through “friend circlesâ€. Has now helped four owners find the missing vehicle. In Zhang Yangjian’s WeChat group, a daily trip was performed to find a car. Dongguan Zhang Hao (a pseudonym) worth 400,000 Audi cars disappeared the next day after they were rented out through a PP rental car. According to GPS information, Zhang Hao and PP car rental risk control personnel rushed to Shenzhen, Zhang Hao met his car at a logistics company, the front glass has been damaged, the driving recorder was disassembled, the memory card inside the car was removed, The lights have also been damaged. Unknown to the night, Zhang Hao stole the car with a spare key. Follow-up information feedback, his car was entrusted to the logistics company by the tenant and wanted to consign it to other places for sale. Zhang Hao was fortunate. Most of the unfortunate owners still rushed to find a car. Some of the owners were not even sure who was in the car. Many police officers told the car owners that such cases were economic disputes and they were not placed on file. Is such behavior fraud, robbery, or economic disputes? There is no uniform argument for the police where many lost car owners are located. Wang Yongjie, a researcher at the China University of Political Science and Law, believes that in Zhang Yang’s case, the vehicle has been identified as “theft†and the police see the stolen vehicle immediately seized. In an interview with the Beijing News, Zhang Yibing, an auto leasing expert, introduced that whether a motorized vehicle is a pawn or a purchase or sale, according to the Administrative Measures for Motor Vehicles or the Measures for Pawning Management, both parties should change the vehicle or change the mortgage in the competent authority. Registration, otherwise mortgage and sale are illegal. In the case of Zhang Yang, Wang Yongjie, the chief researcher of the China University of Political Science and Law, believes that since Zhang Yang, the actual owner of the vehicle, did not mortgage his car, the mortgage contract signed by the tenant and the Bazhou dealership was invalid because it was incomplete. The mortgage of the vehicle formalities itself is illegal, and the party that takes over the car should return the vehicle. In Zhang Yibing’s experience, many tenants transferred their cars without any formalities. Many pawnshops and mortgage dealers also accepted mortgages when they knew that the mortgagee had not completed the procedure and the price was far below the market price. There are even pawn shops and mortgage dealers involved in rental vehicle fraud. At the same time, the crackdown on public security agencies has not been strengthened, and even some cases of investigators have identified fraud cases as economic disputes. “This indirectly condoned fraud.†Flow direction Lease vehicle mortgages flow into the black market In fact, rented vehicles have been mortgaged by tenants and have been resold in the car rental industry. Informed sources have revealed that after several rounds of hand-downs, vehicles can still be used normally and even have their licences on the road. On March 28th, the reporter rented a Chevrolet Epica under the PP car rental platform for a three-day lease period. This purchased a car with an itinerary of no more than 30,000 kilometers in 2006. The rent and the insurance deposit were pre-paid on the platform. 3400 yuan. The process of renting a car is very simple. You only need to send photos related to your ID card and driver's license to register for a car rental account, until the reporter has successfully rented the car and has not received any face-to-face verification of the phone. For the next two days, the reporter drove the vehicle to a number of secured loan collateral dealers to ask if he could do a formal mortgage. Near Sanyuan Bridge, manager Li of an investment management company said that for undisciplined vehicles, the company only accepts mortgages and does not accept resales. “If a car with no formalities is worthless, it can only be sold at a fast transaction price, that is, a black car price.†. Manager Wang of Haidian Zhongguancun Investment Management Co., Ltd. also stated that he can do a mortgage without formal vehicles, but the price is relatively low. On March 30th, in Huashan, the largest second-hand car trading market in Beijing, more than 10 pick up cattle were willing to purchase a car with no formalities that the reporter had rented for around 30,000 yuan. Contrast is not difficult to find the tenants illegally mortgaged or resold the motives, the reporter rented a car deposit only spent 3,400 yuan, and then can easily 30,000 yuan price shot, profit up to nearly 10 times. The second-hand car operator Jia Menghua used the mortgage loan business of used cars for many years. He introduced that the rental car fraud gang has a clear division of labor. Some people support the car rental deposit. Someone is responsible for hiring someone to register for a car rental platform account, and someone is responsible for issuing mortgage information to resell used car information. "They have a very fine division of labor and they don't meet each other." Jia Menghua said that illegal individuals who rent out cars generally publish mortgages or resell information through the Internet or social media. In particular, after the appearance of social tools such as WeChat and Weibo, the fraudulent rental car information is more Flooding. Jia Menghua disclosed that the lawbreakers had one thing in common when they released the news that the price was generally lower than the market price and would use “naked cars out†in the information. “They also have people who are responsible for running fake documents and then mortgage them in the form of regular cars, making them hard to prevent.†Claims There is no uniform payment standard in the industry For Zhang Yang and most vehicle owners, losing a car is a nightmare, and the claim is another nightmare. "At present, no party is willing to bear my losses." In the eyes of car owners, the cost of telephone calls, transportation fees, working hours, and energy spent on finding a car are all small things. If the car is not returned, the car owner will face a series of problems such as the insurability of car indicators, car insurance, and liability for illegal operations. Zhang Yang is particularly puzzled is that, in the case of the vehicle has not been recovered, Po drive car does not want to make any compensation for the loss of the car. Tenants had paid a deposit of about 6,000 yuan for renting a car when they rented a car. Zhang Yang believes that the car was lost and the money should be returned to her as the first compensation, but the incident did not give her a penny for two months. The “prepaid insurance compensation plan†of Baojia Rent-a-Car also does not apply to Zhang Yang’s case, because the advancement of insurance premium payment is only for vehicles that the police have identified as stolen. In the police’s determination, her car was placed on a “fraud†basis. Two other car rental companies in the industry, Youyou Car Rental and PP Car Rental, adopted a back-and-forth compensation method on this issue. For the vehicles that cannot be recovered within three months, the platform will make exceptions and special payments to the loss owners. On March 31, Li Shihu, the owner of the lost car, went to the Youyou Car Rental Platform together with the other five car owners, hoping to get a statement. In the face of the owners’ demands, Wang Xu, Director of Friends Car Rental Public Relations, promised that if the owner fails to retrieve the vehicle within a certain period of time, the platform will also make corresponding compensation based on the assessed value of the vehicle. A risk control staff of the PP car rental company and the owner of the company’s lost car also confirmed that the PP car rental will give the owner appropriate compensation after the owner’s vehicle is lost. If the vehicle fails to be retrieved within a certain period of time, the platform will also respond accordingly. Loss compensation. The risk control personnel said that because there is no clear division of responsibility for the car-losing incident in the industry, they do so to restore the owner’s trust. Supervision Car rental platform "wind control" is a weakness Faced with a large number of lost vehicles, the car rental platform also tried to find a way to crack. The car rental platform has the most rigorous auditing and certification mechanisms. At present, most of the platforms in the review of tenant identity mainly assess suspicious identity, credit history, compliance ability, and personal connections. Finally, whether the taxi driver is suitable for the evaluation of the rental car on the platform. However, all owners of lost vehicles have confirmed that the tenants involved have successfully passed the authentication of the car rental platform. Companies such as PP Car Rental also established their own risk control security team. “Our staff will install a smart box in the audited private car for positioning and navigation. The risk-control security team will monitor the situation in real time for 24 hours. If there is any abnormality, it will respond to the first time.†Zhu Tingting, head of public relations department of the PP Car Rental Department disclose. Like the PP rental car, all car rental platforms at this stage have GPS installed for the vehicles. However, Zhang Yang and other owners believe that this effect is not obvious in the early stages of vehicle fraud. “The tenant will dismantle the GPS for the first time when the mortgage is resold.†An industry source revealed that the GPS with hidden and high functionality is difficult to be disassembled, but it is expensive and it is rarely used by car rental platforms. On March 27th, Youyou Car Rental Co., Ltd. combined with PP Car Rental, Baojia Car Rental, and Bumpy Car Rental set up an industry integrity alliance. Any company with grey order information will be notified of the remaining linkage companies for the first time and make an early warning. This measure began to take effect on the second day. On March 28th, Mr. Zhang from Dongguan successfully recovered the resold vehicles from the warning information sent by other car rental platforms. Solution "The National Car Rental Credit System Should Be Established" Cao Hongming, member of the National Committee of the Chinese People's Political Consultative Conference and the Secretary General of the Zhi Gong Party Central Committee, conducted a detailed investigation on the issue of car loss in the vehicle leasing industry and submitted a proposal during the two sessions this year. He suggested that China establish a national car lease credit system to cope with the increasingly rampant car rental. Fraud issues. He suggested that the Ministry of Public Security, the Ministry of Transport, and the Ministry of Commerce should call the China Road Transport Association and some car rental companies to jointly prepare and build a "car rental credit system." Among them, the public security department provides citizen ID information, information on wanted criminals published abroad, various types of criminal records, and annual inspection records of pilots of traffic control agencies in various places. The Ministry of Transport requires leasing companies to provide data to the "car rental credit system." The department of commerce issues documents to used car dealers, motor vehicle pawns, and mortgage institutions. Vehicles registered in the system must not be traded, pawn, and mortgaged. Zhang Yibing, a senior engineer of the China Road Transportation Association, who participated in the research and preparation of the proposal, also recommended that legislation should be clarified to clearly identify the "mortgage rental vehicles." Zhang Yibing said that some public security departments believe that mortgages, pledges, pawn leasing vehicles are economic disputes, and do not file a case for car leasing companies' reports, leading to car rental fraud crimes that cannot be dealt with in a timely manner. Therefore, it is also recommended that the Ministry of Public Security increase the use of mortgages, pledges, pawns, and resale of rental vehicles as the detailed rules for the implementation of contract fraud in the relevant criminal case handling procedures, and effectively combat car rental fraud. In fact, as early as 2010, the China Road Transport Association had conducted a special study on car rental fraud and drafted a “car rental fraud problem and its solutionâ€, which mentioned the establishment of a national car rental security information system. And improve the legislation, such as clarifying the distinction between “good faith acquisition†and “buy and buy†by third parties, and on the premise of determining the infringement of the interests of the owner of the leased vehicle, determine a special law to support the owner to forcefully retrieve the car, etc. Crack to find the car but do not look back.

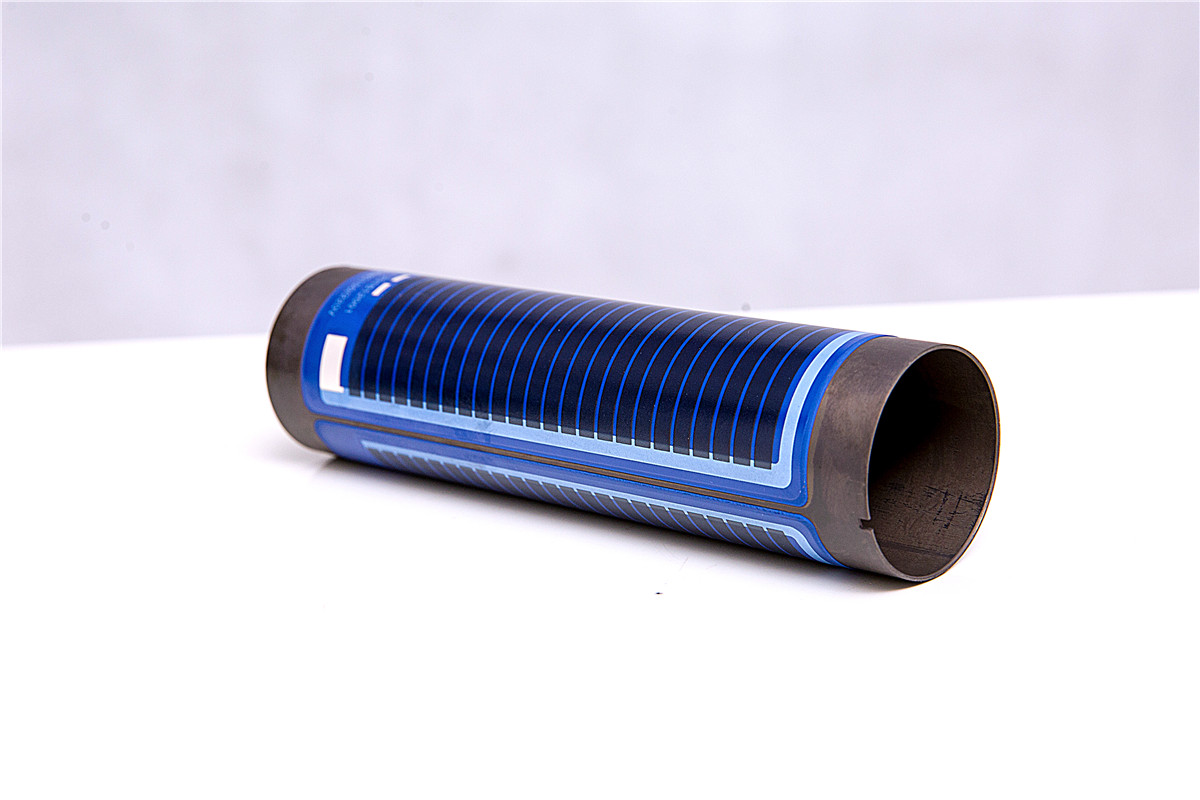

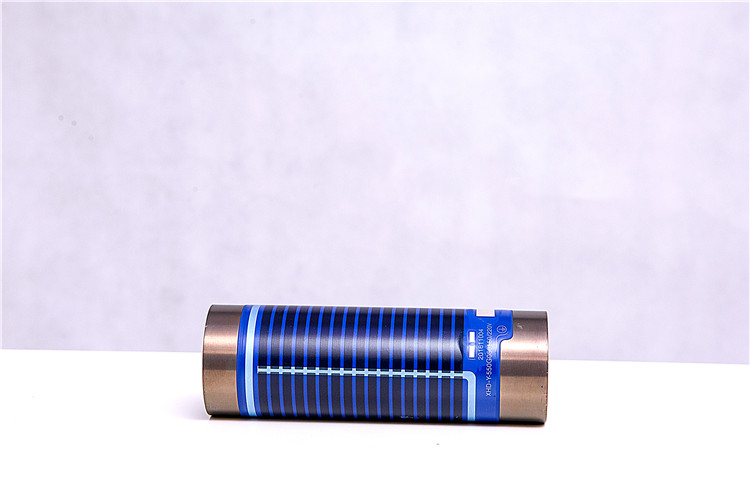

The rare-earth metal thick film heating technology is one of

today's most innovation and forward-looking solution for electric heating field.The

thick film heating tubes/elements are produced by screen-printing dielectrics

(5 layers), resistance (palladium-silver), conductor (silver) and isolation

glazes on the substrate and sintered 7-9 times at temperature over 900℃.

With 6KW Thick Film Heating Tube simple tubular structure, it can heat water flow inside

the tube. Electric Circuit printed on tube surface, to heat the water flow

inside. For

applications where space is limited, this simple profile heater offers high thermal

power density and fast response times to heat up or cool down (due to low

thermal mass)

6000W Thick Film Heating Tubes,Propane Radiant Heater ,Radiant Tube Heaters Prices ,Infrared Radiant Tube Heater XINXIANG JIEDA PRECISION ELECTRONICS CO.,LTD , http://www.gidaheater.com

Related company stocks trend Zhongguancun 11.93 +0.54 4.74%